REITs Get Aggressive

DC's biggest REITs are making big moves in 2013, and armed with fresh capital, they'll continue to turn up the heat this year.

In order to keep those shareholders happy and stock prices high, the DC area's REITs are emerging from hibernation and are getting aggressive in 2013. Actions like WRIT's sale of its medical office portfolio or First Potomac's shopping of its industrial properties might just be scratching the surface, says Kern Investment Research founder Jack Kern (above), since REITs are confident with pricing in the marketplace.

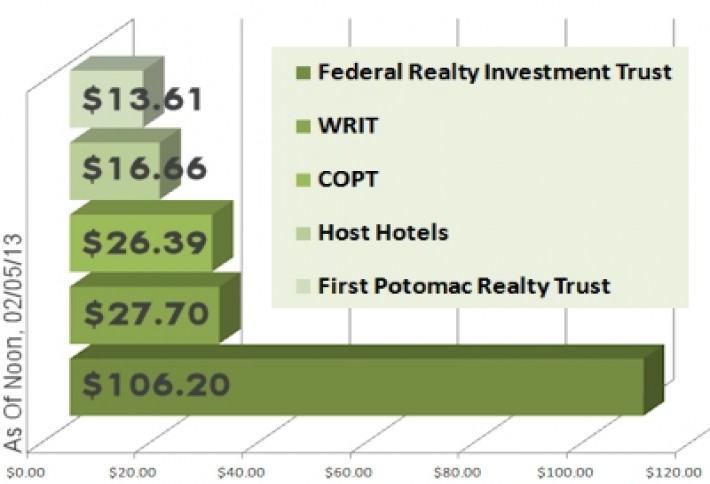

(Above, stock prices for 5 top DC REITs.) Jack also says REITs in bed with institutional players on assets will be active as well. Pension funds and life companies (like MetLife, who bought DC's Constitution Center with Clarion Partners in December for $734M) may want to cash out on local investments, which will allow REITs to purchase those assets outright. And while we probably won't see prices rivaling Constitution Center's tag, Jack says it's realistic to expect several deals, for both portfolios and single assets, with prices $100M and up.

Area REITs may also be making acquisitions of another kind in 2013--buying other firms. They may not be as big as Equity Residential and Arlington-based AvalonBay's pending $16B buy of Archstone (and its Wisconsin Place apartments in Chevy Chase, above), but as the firms continue to be on the offensive, the scooping up of smaller competitors to keep pace is likely.