How Roofstock Plans To Change Investing In Rental Homes

Roofstock is an Oakland-based online marketplace with plans to disrupt the single-family rental (SFR) market. The veteran team includes SFR bankers, financiers and serial entrepreneurs. Bisnow spoke to CEO Gary Beasley about the challenges, how Roofstock will revolutionize the way people invest in rental homes and hiring the right people for success.

Bisnow: What does Roofstock do and how did you get started?

Gary Beasley: Roofstock is the first dedicated online marketplace for investing in leased single-family rental (SFR) homes. Basically, it’s a new, more efficient way to buy and sell investment properties.

My co-founders and I are all early SFR industry pioneers. Gregor Watson founded 643 Capital Management, a leading SFR investment firm. As a managing director at Jefferies, Rich Ford was widely regarded as the leading investment banker in the SFR industry, and among the first to embrace it as an institutional asset class more than five years ago. Devin Wade’s expertise is in payments and secure processing, having founded multiple successful startups. I’m the former CEO of Waypoint Homes and co-CEO of public SFR REIT Starwood Waypoint Residential Trust, which amassed over $3B of SFR assets during my tenure. I also spent five years building the online residential brokerage firm ZipRealty, now part of Realogy, which I took public in 2004 as its CFO.

We came together last year because we wanted to democratize the tools we had as institutional investors, and make SFR investing for everyone as easy and transparent as using E*TRADE to buy and sell stock.

Bisnow: What do sellers get out of using Roofstock?

Gary Beasley: For sellers, first and foremost, we offer a global community of ready investors who are interested in buying homes with tenants in place. That means sellers don’t have to vacate the homes to sell them.

Not having to vacate the home is a critical differentiator because doing so to sell it through traditional channels is expensive and time-intensive. Between the lost income, renovation costs required to successfully market a home to retail buyers, and high brokerage commissions, the all-in cost to sell these homes is typically 10% to 12% of its value. With Roofstock, sellers can do it all for 2.5%, and they receive income right up until closing. No need for showings or signs in the yard. We pay for all the upfront certification work. Buyers invest through the platform without having to physically visit the properties because our technology allows them to virtually tour the properties. This way tenants aren’t disturbed with showings.

Bisnow: What do buyers get that they can't elsewhere?

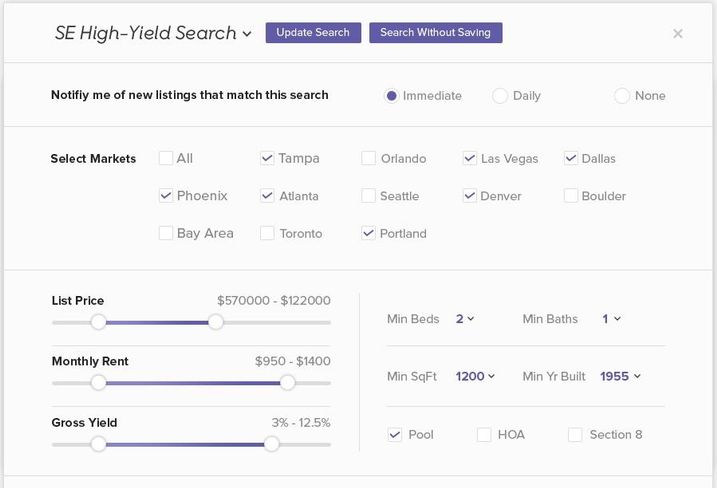

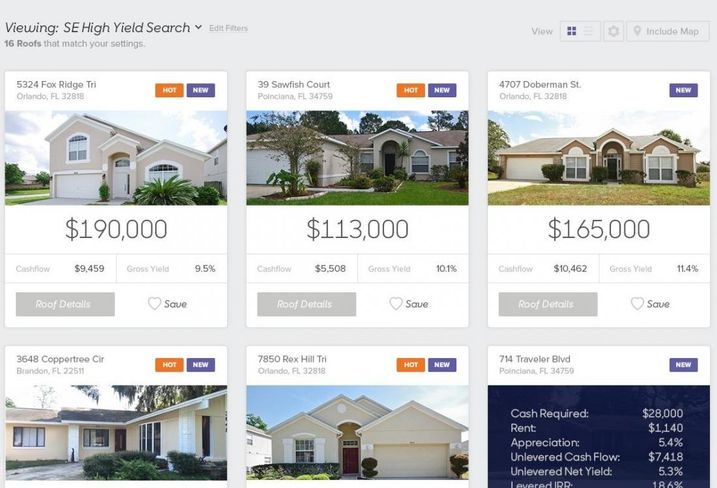

Gary Beasley: On Roofstock, buyers get access to a proprietary, curated inventory of vetted homes with current cash flow and professional property management in place.

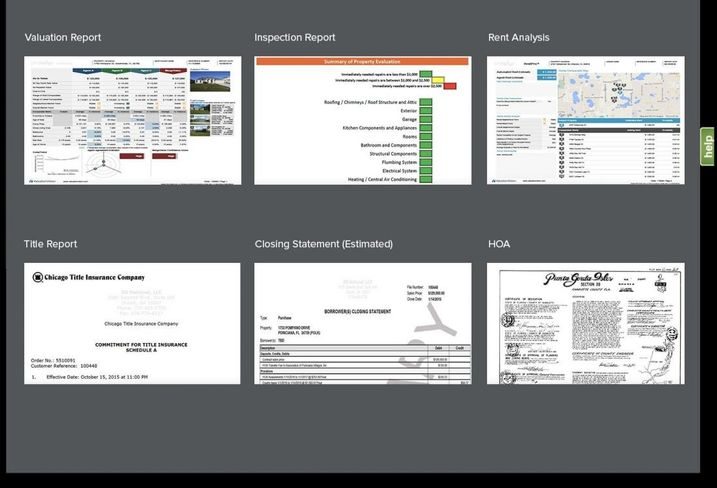

We use independent, third-party experts to inspect and certify homes as part of the listing process. Then we provide a host of very simple-to-use analytical tools and quite a lot of diligence information up front to help you evaluate and compare properties before buying them. (See above for an example of Roofstock’s digital diligence wallet.)

We also leverage electronic document delivery and e-signatures that make it possible to close transactions quickly and securely.

Unlike a traditional real estate process, all the homes on the site can be purchased at set prices, avoiding the frustrating experiences often associated with bidding or auction processes. Moreover, the prices factor in both market comparables and property-specific conditions. Buyers also benefit from the sellers being able to list for less and still net more given the dramatically lower marketing costs of the Roofstock marketplace.

It is a win-win for both buyers and sellers, as we are wringing out costs and time in the transaction process that can be shared by all participants in the transaction.

Bisnow: What challenges do you see ahead and how do you plan on overcoming them?

Gary Beasley: The hardest thing with any marketplace is balancing supply and demand appropriately, and we are not immune from that challenge. The good news is we are confident robust demand exists from both buyers and sellers, given early traction and conversations with early and potential market participants. The balance between supply and demand will be a constant back and forth, but that’s the magic of marketplaces. You need supply to generate demand, and more demand to attract more supply, and so on.

Bisnow: What was the biggest lesson you learned in running your company?

Gary Beasley: Roofstock is the third company I’ve had the privilege to run, and without question, the biggest lesson I have learned over the years is to hire the absolute best people you can for your team. It sounds obvious, but the key is how you define best. I do not hire just for aptitude, but critically, also for attitude. In any dynamic environment, there will be difficult challenges and strategic pivots. To be successful, we need people who are team players who are invested in the success of the organization, not just themselves.

Has anyone heard of the Golden State Warriors? I recently met their GM, Bob Myers, and 100% agreed with his philosophy of hiring for character to win championships. This isn’t as hard to solve as it may seem if it truly is a focus. One bad hire can be worse than 10 good ones, so take the hiring process seriously. Intelligence and accomplishment are foundational and get you an audience; cultural fit and a real commitment to the organization’s mission gets you the job.