Apartment Incentives May Return Soon

In the 10 years Madison Commercial Properties Greg Johnson has been tracking apartment sales, prices have never been this steep for investors, particularly small apartment complexes. This may signal a return to apartment incentives.

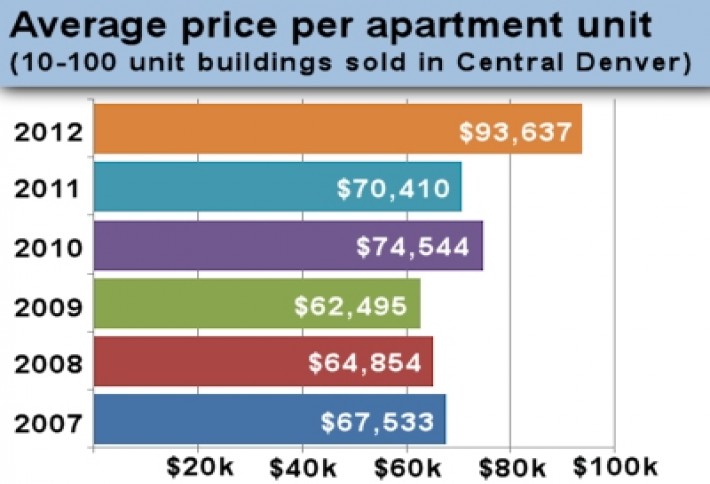

The Denver market has exploded, Greg (herewith his partner Kyle Malnati)told us during a chat this week.From 2001 to 2011, the average price per apartment unit in Denver climbed from $61k to $70k, a healthy rise. In 2012? The average price skyrocketed to $94k (specifically apartment buildings of 100 units or fewer). Whats driving it: a perfect storm of investor demand, low vacancies, rising rents, and an overall lack of product for sale. (A storm like this means it's rainin' cash.) Vacancies haven't been this low since before the dot-com bust, he says.

Gregs most recent sale was 1916 S Columbine St--a seven-unit studio apartment complex in Observatory Park near the University of Denver--that sold to private investors for $1.3M, or $185k/unit. The unidentified investor paid cash for the property. He's not aware of anything in Denver that's been sold privately reaching anything close to that number.

And 1916 S Columbine is not an outlier, Greg says. Two other properties he has under contract to investors are both fetching record pricing. One--1050 Emerson (above), with 10 units on Capitol Hill--is under contract to trade for more than $100k/unit. And 764 Cherry Street, a 12-unit apartment building, could trade for $137k/unit if the sale closes. (At this rate, you could probably get at least $10/unit in a doll house.) Those are numbers that would have seemed certainly unachievable--near crazy--12 months ago, he says.

[caption id="attachment_50397" align="alignnone" ] Source: CoStar[/caption]

Source: CoStar[/caption]

So, is multifamily now too hot in Denver? CoStar stats show the apartment unit pricing spike in the past year alone. I dont believe its a bubble, Greg says. Our prices have been driven by higher rents. But he concedes that the level of new construction runs the risk of outstripping demand 11,000 new units, mostly high rent, are under way in Denver and another 16,000 are on the drawing board (with 11,000 units absorbed from 2010 to 2012). What will likely happen is a return of renter incentives for the first time in a decade as landlords rush to fill their product. All these developers will be scrambling to fill their units so they can get out of construction financing and get permanent financing in place.