News

Four Things You Need To Know About The Hotel Industry In 2016

Transaction activity and RevPAR growth slowed in Q1, but the underlying fundamentals of the lodging sector remain strong. That was the overarching message of JLL's Q1 2016 report on the hotel industry, which goes on to identify four major trends that look to shape the industry moving forward.

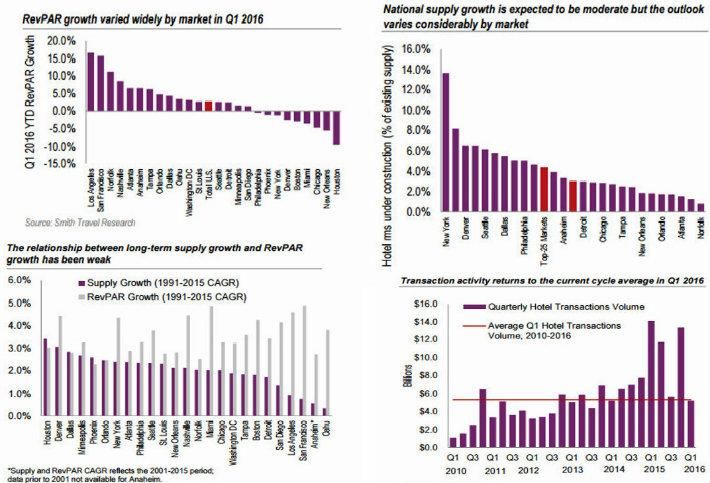

- Top Left: RevPAR growth in Q1 2016 rose only 2.7%, a significant deceleration following the 8% and 6.3% growth rates of 2014 and 2015, respectively.

- Top right: The number of hotel rooms under construction in 2015 amounted to 2.8% of the nation's total number of hotel rooms, and that figure climbed to 3% as of March 2016. The pipeline of new construction is generally bigger in the top 25 markets. New York and Miami have emerged on top in 2016 so far, with rooms under construction representing 13.7% and 8.2%, respectively, of all existing hotel rooms in those cities.

- Bottom left: JLL compares annual RevPAR growth to annual supply growth for the top 25 US markets from 1991 through 2015. It found minimal correlation between the two variables, at -0.28. The major takeaway is that the current new supply pipeline does not tell us much about the prospects for RevPAR growth for individual markets.

- Bottom right: First the bad news—US hotel transaction volume declined from $13.4B in Q4 2015 to $5.2B in Q1 2016. That's an almost 60% drop in sales activity. That might sound devastating, but JLL says it's actually a return to normal. Last year saw an all-time high in hotel acquisition activity since JLL began keeping track over 15 years ago. While the deal level volume decline for 2016 is considerable, this year's numbers are actually in line with the average quarterly transaction volume in the current cycle.