Where To Find Distressed Properties First

PHILADELPHIA Distressed properties are speeding to market as banks become more willing and able to write off losses, says Charlie Plyter (with colleague Ted Colberg). Parent company Napco launched NewAcre to give investors a head start on REO and foreclosed properties, adding them to an online database as they show up in public records. The database launched in September (though it has access to older data) when 251,000 REO/foreclosed properties were up for grabs. Today there are 370,061.

[caption id="attachment_55694" align="alignnone" ] Source: NewAcre[/caption]

Source: NewAcre[/caption]

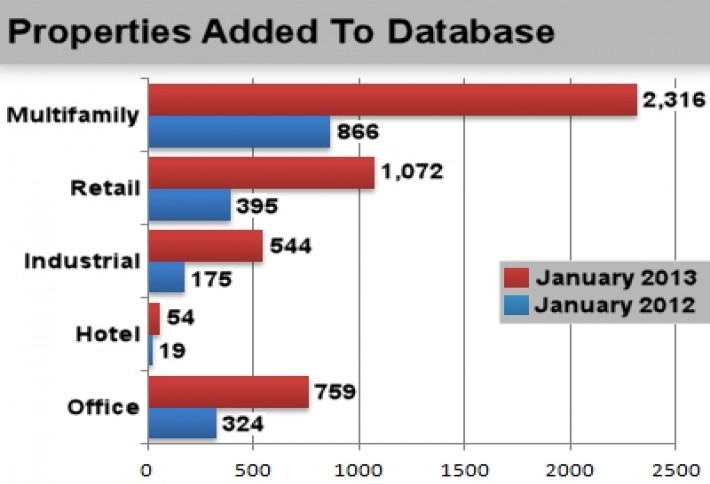

Above are the properties added to NewAcre's database (January is the most recent month for which final tallies are available). Itnow lists more retail than anything ($31B). Charlie says most retail properties that were doomed for trouble are already with their banks, and now those banks are putting them out for the public. Next in volume is multifamily ($30B).He tells us investors are eager to be first in line to pay banks all cash for the notes on pre-foreclosed residential properties. And $29B worth of office is ripe for the picking, the most being added to NewAcre's database from Florida, California, and Illinois.

[caption id="attachment_55746" align="alignnone" ] Source: NewAcre[/caption]

Source: NewAcre[/caption]

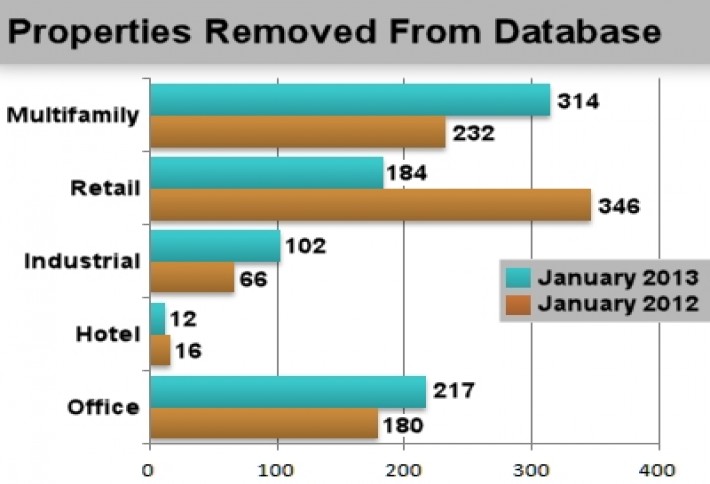

Industrial properties that have been "cured" (meaning banks sold the REO and so NewAcre has removed the properties from its database) jumped from $25.8M in January 2012 to $561M this past January. $10B worth is now available. Hotels and motels represent the lowest dollar volume ($3.6M), Charlie tells us, but attract a disproportional number of inquiries from the service's subscribers.