Carlyle Considers Core-Plus RE Strategy

Carlyle Group is considering a new "core-plus" real estate strategy with the goal of 10% returns. The world's second largest alternative asset manager (behind Blackstone) will gauge whether investors are interested in commercial and residential properties that are less spiffy than the "core" asset class of prime shopping malls, office buildings and apartment towers.

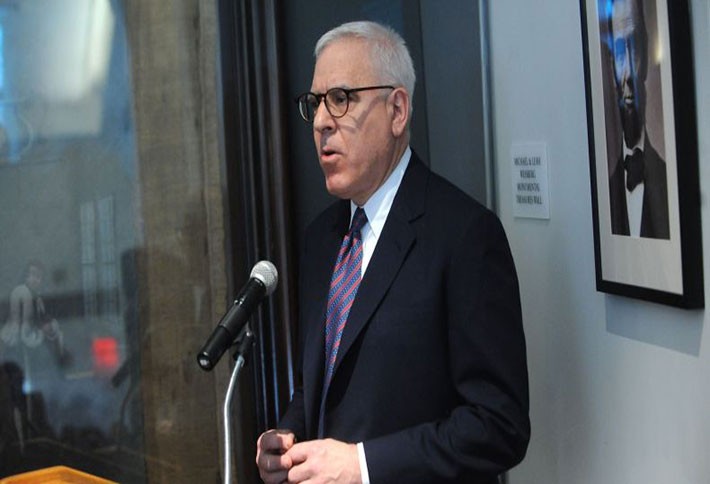

"We are looking seriously at the core-plus business,” Carlyle co-founder David Rubenstein said today at a Morgan Stanley conference in Manhattan. “Core-plus is likely to be a very great growth business in real estate, critically in the United States. Nine to eleven percent, because interest rates have been so low, is a very attractive range for a lot of investors now.”

Washington DC-based Carlyle currently operates a $15B real estate portfolio created in 1997. While its American assets have performed well, European investments have struggled. Blackstone a little over a year ago set its sights on the core-plus sector after reaping big rewards from its opportunistic investments during and after the subprime crisis. Blackstone now has roughly $93B in real estate assets under management. [Bloomberg]